Kenya 🇰🇪

Get started with Flutterwave in Kenya

Flutterwave supports various payment options, allowing businesses to cater to customer preferences and potentially increase conversion rates. You can accept payments using most of the payment methods available in Kenya.

Supported payment methods in Kenya are:

Integrate Flutterwave into your Application

Follow the steps below to integrate payment into your application.

-

Create a Flutterwave Account: Navigate to the sign up page and fill in the required form to create an account.

-

Get Your API Keys: Navigate to the API keys section under the Settings menu to obtain them. You need the API keys to authenticate transactions and securely communicate with Flutterwave’s server.

-

Select an Integration Method: Depending on your need, you can select from any of the methods below:

Integration Method Description HTML checkout Payment done with only HTML form containing payment details. Flutterwave inline Use a lightweight JavaScript library to process payment on your checkout page. Frontend SDKs and plugin Use Flutterwave’s SDKs and plugin with your favourite frontend frameworks and libraries to process payment. Backend SDKs Use Flutterwave’s backend SDKs with favourite backend frameworks and libraries. Mobile SDKs Use Flutterwave’s mobile SDKs with your favourite mobile framworks. Flutterwave standard Process payment from your server using Flutterwave’s endpoints -

Process Payment and Test: Using any of the payment methods, you can integrate a payment gateway into your application and test your integration using Flutterwave’s mock data to simulate real-world transactions.

-

Handle Errors and Edge Cases: Implement a robust error-handling mechanism to deal with unsuccessful payments, expired cards, and other payment-related issues. Check out the common errors you might encounter and best practices to follow when integrating payment.

Go Live and Accept Real Payments

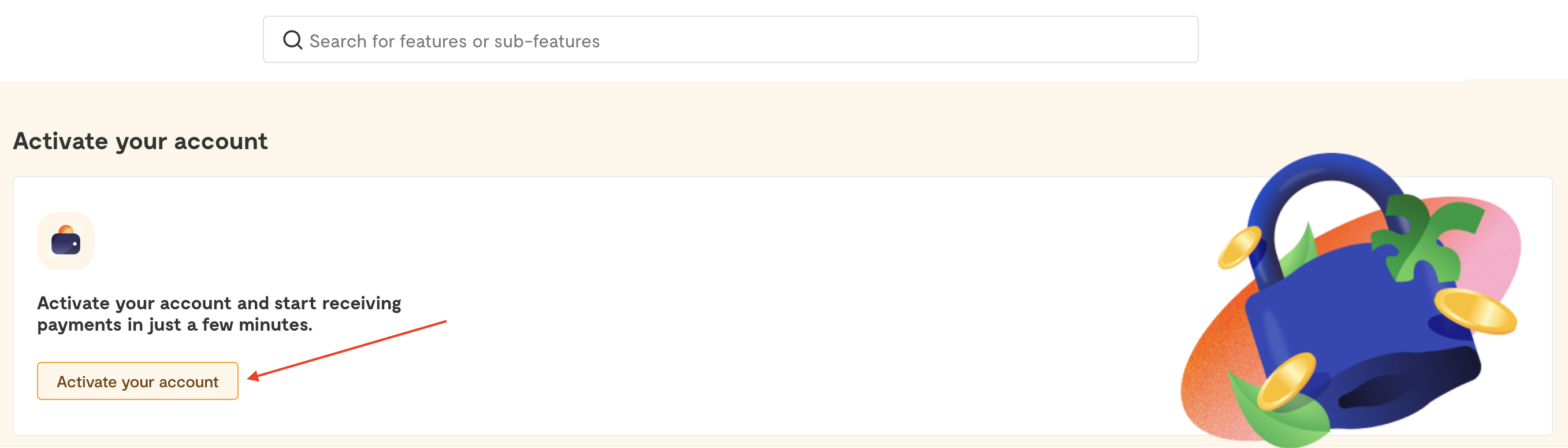

To start accepting real payments, you need to verify your account. Log into your Flutterwave dashboard and click the Activate your account button.

The documents required depend on the business entity. However, several common documents and details are generally needed regardless of the entity:

- Valid Means of Identification: This includes Kenya National ID, International Passports, NTSA Smart Driver's License, or Alien Card (for non-Kenyan citizens).

Provided IDs

IDs must be clear, legible, and have an expiration date that is no sooner than 6 months from the submission date.

-

Proof of Address: Documents such as

- Utility bills

- Bank or mobile money (MoMo) statements

- Tenancy agreements

- Reference letters confirming your address from a bank or MoMo provider

- Voided cheque showing your address

- Tenancy agreement indicating your address.

-

Payout Details: Bank accounts or MoMo details services are required to process payouts, refunds, and other related services.

Required Details

Details should include account number, bank name, account name, email, phone number, and SWIFT code where applicable.

-

Business Information: A verifiable website or social media page and estimated monthly sales are required. Additionally, registered businesses must provide incorporation documents and shareholder details.

-

Resident Permit (if applicable): Only required if the business owner or representative’s nationality is different from the country where the account is being opened.

Acceptable IDs

Note that only color photo IDs are accepted for verification.

In addition to the general requirement specified above, the requirements for going live in Kenya depend on the account category you are signing up for.

Unregistered Businesses

You need the following:

- Business profile detailing the nature of business activities.

- KRA PIN and certificate.

Sole Proprietorship Business

You need the following:

- Certificate of registration/E-citizen certificate with QR codes.

- Individual Pin Certificate of the Business.

Limited Liability Company

You need the following:

- Original Certificate of Incorporation with QR codes for E-citizen.

- CR12 (not older than 90 days).

- Memorandum and Articles of Association (MemArt).

- Shareholder structure

- Board resolution confirming that approval has been given to open an account with us.

- KRA PIN Certificate of the Business/Tax Exemption Certificate.

Other Entity Account

You need the following:

- Constitution / Memorandum of Guidance

- Operating License/Permit

- Memorandum and Articles of Association (MemArt)

- Board resolution confirming approval to open an account with us.

- KRA Pin Certificate of the Business/Tax Exemption Certificate.

FAQ

Can I upgrade my unregistered business account to a registered business account?

If you need assistance upgrading your account, please contact our support team at [email protected]..

What payout (transfer) methods are available to Kenyan merchants?

We currently offer two payout (transfer) methods for Kenyan merchants:

- Mobile Money (Mpesa & Airtel money): You can choose to receive your payouts directly to your mobile money account. This option provides a convenient and secure way to access your funds on your mobile device. Make sure you have a valid and active mobile money account in Kenya.

- Bank Account: We also support payouts to your bank account in Kenya. You can provide us with your bank account details, including the bank name and your personal account number. Once your payouts are processed, the funds will be deposited directly into your bank account.

During signup, you will have the opportunity to select your preferred payout method based on your convenience and preference.

What Collection method is available to Kenyan customers?

Kenyan businesses can use the following collection methods: card and MoMo, which includes Mpesa and Airtel Money.

Can foreign nationals open business accounts in Kenya?

Yes, foreign nationals can open business accounts in Kenya. To do so, you must provide the necessary identification documents, work/resident permits or authorizations, a valid Identity document, and meet the other requirements set by the bank.

Can I use a mobile money (MoMo) account instead of a bank account?

Yes, you can use a mobile money (MoMo) account in place of a bank account. To set up your account, select MoMo as your preferred payout method and provide your account details.

Updated 4 months ago