South Africa 🇿🇦

Get started with Flutterwave in South Africa

You can accept payments from most payment methods available in South Africa. Flutterwave supports various payment options, allowing businesses to cater to customer preferences and potentially increase conversion rates.

Supported payment methods in South Africa are:

Integrate Flutterwave into your Application

Follow the steps below to integrate payment into your application.

-

Create a Flutterwave Account: Navigate to the sign up page and fill in the required form to create an account.

-

Get Your API Keys: You’ll need the API keys to authenticate transactions and securely communicate with Flutterwave’s server. Navigate to the API keys section under the Settings menu to obtain them.

-

Select an Integration Method: Depending on your need, you can select from any of the methods below:

Integration Method Description HTML checkout Payment done with only HTML form containing payment details. Flutterwave inline Use a lightweight JavaScript library to process payment on your checkout page. Frontend SDKs and plugin Use Flutterwave’s SDKs and plugin with your favourite frontend frameworks and libraries to process payment. Backend SDKs Use Flutterwave’s backend SDKs with favourite backend frameworks and libraries. Mobile SDKs Use Flutterwave’s mobile SDKs with your favourite mobile framworks. Flutterwave standard Process payment from your server using Flutterwave’s endpoints -

Process Payment and Test: Using any of the payment methods, you can integrate a payment gateway into your application and test your integration using Flutterwave’s mock data to simulate real-world transactions.

-

Handle Errors and Edge Cases: Implement a robust error-handling mechanism to deal with unsuccessful payments, expired cards, and other payment-related issues. Check out the common errors you might encounter and best practices to follow when integrating payment.

Go Live and Accept Real Payments

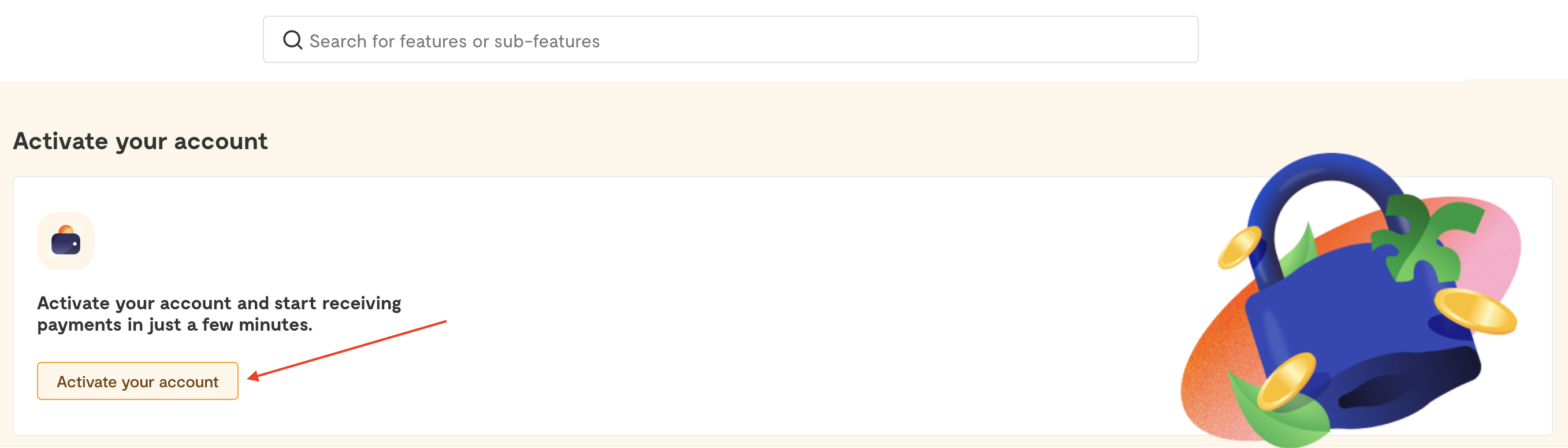

To start accepting real payments, you need to verify your account. Log into your Flutterwave dashboard and click the Activate your account button.

The documents required depend on the business entity. However, several common documents and details are generally needed regardless of the entity:

- Valid Means of Identification: This includes South Africa National ID Cards, International Passports, Smart-ID, Green Identity Documents, or Driver's Licenses.

Provided IDs

IDs must be clear, legible, and have an expiration date that is no sooner than 6 months from the submission date.

-

Proof of Address: Documents such as

- utility bill or municipal bill

- Statement from property managing agent or lights account

- Telephone or cellular telephone statement

- Business statement other than your own

- Signed lease or rental agreement not older than 12 months

- Letter or statement from a corporate or governing body

- Insurance policy documents.

-

Payout Details: Bank accounts or MoMo details services are required to process payouts, refunds, and other related services.

Required Details

Details should include account number, bank name, account name, email, phone number, and SWIFT code where applicable.

-

Business Information: A verifiable website or social media page and estimated monthly sales are required. Additionally, registered businesses must provide incorporation documents and shareholder details.

-

Resident Permit (if applicable): Only required if the business owner or representative’s nationality is different from the country where the account is being opened.

Acceptable IDs

Note that only color photo IDs are accepted for verification.

In addition to the general requirement specified above, the requirements for going live in Kenya depend on the account category you are signing up for.

Unregistered Businesses

You need the following:

- Business profile detailing the nature of your business activities.

- Copy of SARS document confirming income tax number

Sole Proprietorship Business

You need the following:

- Operational business address with attached proof of address

- Copy of SARS document confirming income tax or VAT registration number for the company

- Bank-stamped bank statements or bank letters

Limited Liability Company

You need the following:

- Shareholder structure

- Operating license (where business is regulated)

- Bank-stamped bank statements or bank letters

- Copy of SARS document confirming Income tax/VAT registration number for the company

Other Entity Account

You need Bank-stamped bank statements or bank letters

FAQ

What is a Tax Identification Number?

A Tax Identification Number (TIN) in South Africa is a unique 10-digit number issued by the South African Revenue Service (SARS) for tax purposes. It identifies individuals and entities and is required for tax-related transactions such as filing returns and paying taxes.

How long does it take to approve my account?

The account approval process usually takes 72 hours. You will receive an email notification once your account is approved. If you have further questions or need assistance with your account, please contact [email protected].

Can I upgrade my unregistered business account to a registered business account?

For assistance upgrading your account, please contact our Support team at [email protected]. You can also checkout the specific account upgrade requirements.

What payout (transfer) method is available to South African merchants?

We have two payout options for South African merchants: direct bank transfers and wallet payouts. Using these options, you can quickly transfer your funds directly to your designated bank account or from your wallet to another Flutterwave business wallet.

When signing up, you need to provide your bank account details, including the bank's name, account number, account name, email address, phone number, and SWIFT code (if applicable). This information is necessary to transfer your payouts to your preferred bank account.

What collection method is available to South African businesses?

South African businesses can choose from a range of collection methods, such as card collection, bank collections (including NEDBANK, FNB, ABSA, STANDARD BANK, INVESTEC, AFRICAN BANK, BIDVEST BANK, TYMEBANK), 1Voucher, Apple Pay, and Google Pay.

Updated about 1 month ago